by Fereidoon Sioshansi, Menlo Energy Economics

An attractive opportunity has emerged with so many homes and businesses installing solar panels on their roofs – with many pairing/backing them up with batteries. At the same time, the uptake of electric vehicles (EVs) is accelerating in many key markets.

EVs can be thought of as massive batteries on wheels. Instead of allowing each customer or EV owner to generate, consume and store energy individually and haphazardly – which is currently the case – why not aggregate them and optimise the entire portfolio’s assets? The technologies and tools to do this are mostly available. It is merely a matter of aggregating and managing, which can be achieved through software and artificial intelligence (AI) – at least on paper.

In a 14 July 2022 PV Magazine article titled Can homes with solar plus storage act as virtual power plants? Ahmad Faruqui explores how this can be done using his own solar generation, consumption and storage profile.

Faruqui notes that for a customer on Pacific Gas & Electric Company’s (PG&E) EV2-A tariff, “… the off-peak period begins at midnight and runs to 15h00. The peak period begins at 16h00 and runs to 21h00. All other hours are the mid-peak period. When the sun is charging the battery in the morning, the house is buying power from the grid at the lowest rate. When the battery begins discharging at 16h00, the house avoids buying power at the most expensive rate. Typically, customers don’t let the battery discharge totally. They keep a certain amount of battery power in reserve, such as 30%, to guard against power outages.”

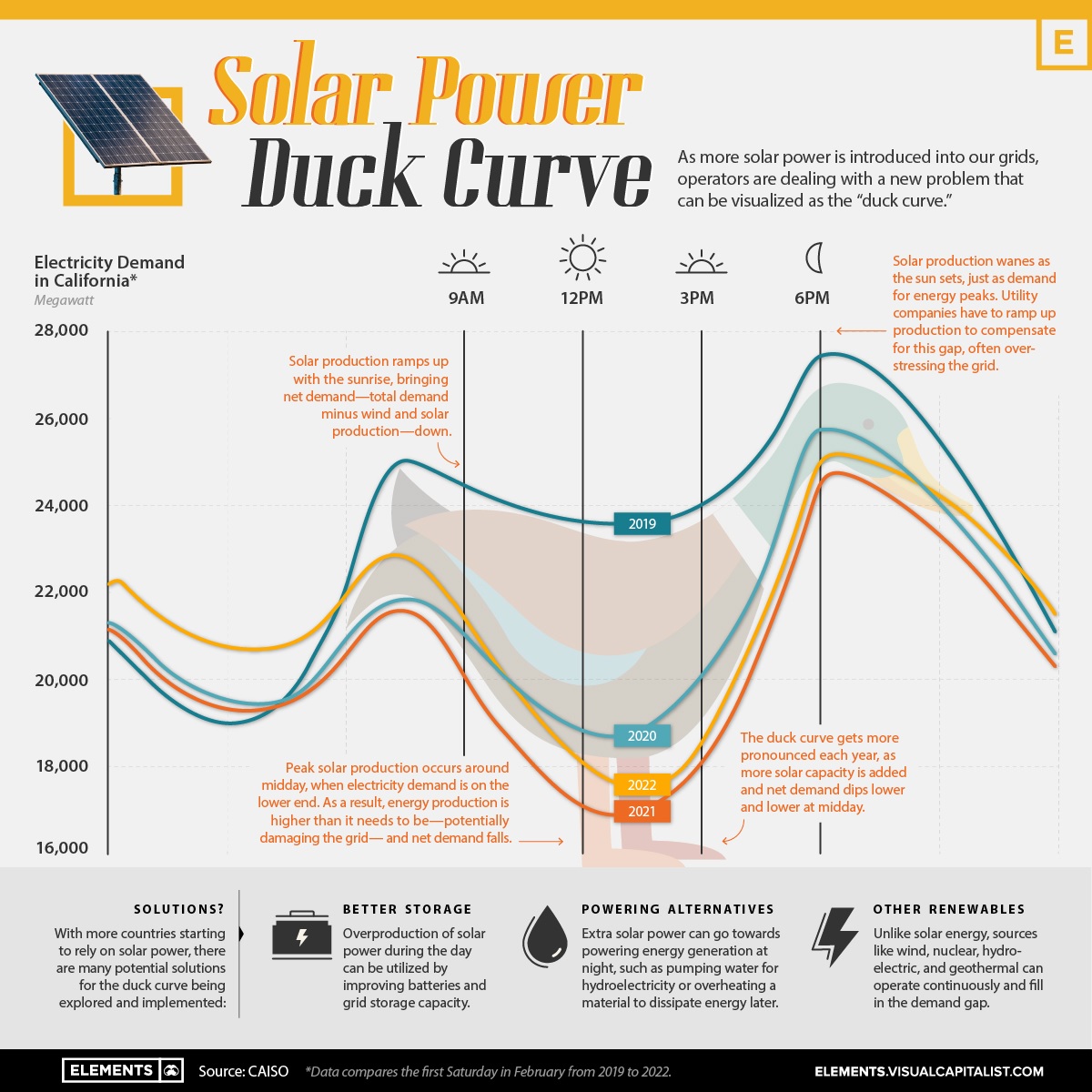

With California’s notorious “duck curve” and chronic shortages during extreme heat waves, why not turn homes with solar plus storage into virtual power plants (VPPs)?

Such customers can avoid buying expensive power during periods when the rates are 56 US cents/kWh on the EV2-A schedule by powering their home with the battery and be paid $2 per kWh for exporting power from the battery – and potentially from the EV – to the grid.

The idea sounds compelling in theory. But will it pan out in practice? Using data from his own solar plus storage at his house, Faruqui examines what happens on a mild vs. an extremely hot day.

On 29 June 2022, a mild sunny day, his 8 kW solar system produced 49,41 kWh while the house consumed 23,32 kWh, with the balance exported to the grid (visual on next page - Figure 1)). Faruqui also has a battery rated at 9,8 kWh and a Tesla EV, which means he can store some of the excess generation for later use – and potentially discharge to the grid given sufficient incentives and the necessary gadgets.

On most sunny days, as the accompanying graph (Figure 2) shows, “… the house was self-sufficient until almost midnight. I could have availed myself of the VPP mode and come out ahead.”

Needless to say, aggregating thousands of such solar plus battery systems represent a significant untapped resource. Which explains why Customer Choice Aggregators such as MCE are enticing customers with solar plus batteries to enroll in programmes to do precisely what Faruqui refers to, namely allowing the operation of their assets to be optimised by a third party.

But what about those really hot days when the California Independent System Operator’s (CAISO) network is stretched to the limit? Can the customers with solar + storage come the rescue?

During an extreme heat wave on 14 and 15 August 2020, CAISO encountered a serious emergency resulting in outages affecting hundreds of thousands of customers. The shortages occurred during the evening ramping period, the dreaded neck of the “duck curve.”

Faruqui notes that during such episodes,

“… Homes such as mine did not have much of a surplus to send to the grid. I was actually concerned whether I had enough to keep my lights on in case the grid lost power. Why would I have exported power to the grid on either day?”

On 14 August, his system generated 32,79 kWh while the house consumed 63,12 kWh – it was a very hot day indeed. As seen in the accompanying graph, “… around 5 pm, the battery was unable to keep up with the consumption…” which meant that Faruqui was “… importing power from the grid. This would not have been the time to release whatever battery power I had remaining to the grid, regardless of the price being offered to me.”

A similar pattern was encountered on the following day, 15 August, another hot day, when his system generated 34,76 kWh while the house consumed 60,55 kWh. Faruqui notes, “On neither day would I have wanted to export any power from the battery to the grid. Instead, I wished I could have tapped into the battery in my Tesla that was parked in the garage. When fully charged, the car’s battery holds upwards of 70 kWh of energy. My wish could not be fulfilled because Tesla does not allow power to be pulled from the battery to power either the house (or to export it to the grid). Additionally, I would need to install a two-way charger rather than the one-way charger I currently have in the garage.”

Of course, in a large network such as CAISO with hundreds of thousands of solar plus battery system, one would expect more diversity and hopefully more flexibility. But as Faruqui notes, on those critical days when CAISO is most desperate there may be few extra resources to expect from the solar plus storage customers – unless:

- The customers are incentivised to oversize their batteries specifically for such days; and/or

- The substantial storage capacity of EVs are integrated into the scheme, allowing them to discharge some of the stored energy back to the grid during the critical peak hours. California currently has over 1 million EVs – more than the next ten states combined – representing the biggest distributed energy storage system in the state.

As Faruqui points out, for this to happen, customers with solar, batteries and EVs need to be incentivised to invest in additional hardware and software that allows them to become more active participants in the market. We are not quite there yet, and that is a pity especially given the large storage capacity of the EVs – which currently are not used to discharge during peak demand periods.

Clearly more work needs to be done, especially in implementing vehicle-to-grid (V2G) technology as the number of EVs in the network increases over time. The opportunities are so lucrative – and the penalties for inaction so dire – that it will happen, sooner or later. The “duck curve” will compel consumers, prosumers and prosumagers to become more active participants in the electricity market.

Private vs. public value of US residential battery storage operated for solar self-consumption, a recent report from the Lawrence Berkeley National Laboratory (LBL) quantifies the value of using residential battery storage to maximise solar self-consumption from the perspectives of both the individual solar customer and the larger power system.

According to the LBL report, “This question is becoming increasingly relevant as states replace traditional net metering rules with “nett billing” structures. Nett billing allows customers to offset their own consumption with solar on an instantaneous or hourly basis, receiving full retail rate credit for that portion of their solar generation (area B in the schematic (Figure 3)), but any solar generation exported to the grid is compensated at a reduced rate (area A).”

“This kind of asymmetric pricing structure incentivises solar customers with battery storage to charge their batteries with surplus solar and discharge that stored solar energy to serve load during evening and night-time hours (area C).”

The significance of electricity generation from small-scale, customer-sited photovoltaic (PV) solar is becoming pronounced nearly everywhere including in not-so-sunny New England where it is already changing the hourly pattern of metered electricity demand, especially during the [northern hemisphere] spring – March to May.

According to the Energy Information Administration (EIA), small-scale solar in New England is rapidly decreasing demand during the morning while increasing during the evening, especially during cool but sunny spring months - call it New England’s version of the “duck curve.”

The EIA reports that solar capacity in New England has increased by 3,8 GW since 2016, resulting in falling electricity demand as the sun rises, followed by rising demand after the sun sets. More than half of New England’s 3,8 GW of PV capacity additions since 2016, or 2,3 GW, have been small-scale solar.

These developments are forcing retailers, distribution companies and grid operators to rethink how best to serve the changing needs of their customers while balancing supply and demand on the network. Many observers believe that new business models will emerge to deal with the new realities of distributed generation, storage as well as the rapid proliferation of EVs with their massive batteries.

Asked to comment on the phenomenon, which is even more pronounced in Australia, Bruce Mountain, the Director of the Energy Policy Centre at the University of Victoria in Melbourne, Australia, said, “In Australia, rooftop solar capacity is close to 20 GW – approaching 1 kW per person. Battery systems are growing quickly and ‘zero upfront’ build-own-operate-transfer solar plus battery bundles are proving to be a big hit.

Virtual power plant functionality for behind-the-meter batteries is new – but offered by many retailers – and may be an important part of the economics of residential battery uptake. Australia’s largest coal power station is scheduled to close in three years’ time and its owner has said it intends to replace much of its production with behind-the-meter solar and battery capacity, with virtual power plant functionality. It will be fascinating to see how this market develops.”

Currently roughly one-fifth of Australian solar homes have battery storage. A recent national survey by Solar Citizens found that an astonishing 84% of solar homes without a battery are looking to add one in the next three years and indicated that a subsidy somewhere between AUS$3000 to 6000 would get them over the line. Clearly there are big opportunities to turn such customers into active market participants.

Acknowledgement

This article was first published by EEnergy Informer and is republished here with permission.

Send your comments to rogerl@nowmedia.co.za