Information from the South African Department of Science and Innovation

The government’s scientific community, together with the private sector, is working hard to develop a new, clean, and abundant source of energy: Hydrogen.

It has been reported that maximising renewables penetration of the power sector with enhanced coal retirements can only directly eliminate 40 to 45% of total CO2 emissions.

Although one often thinks of solar and wind when the term “renewable energy” comes up in conversation, hydro (i.e., water) and hydrogen are valid and practical renewable sources of energy too.

The Department has published a report on its findings and makes recommendations regarding South Africa’s potential hydrogen economy.

This report follows a statement made by the President of South Africa, in his most recent State of the Nation Address that hydrogen fuels cells are a national priority as an alternative energy source.

South Africa's hydrogen valley: Final report

This is the executive summary of the report

Hydrogen Valley and hydrogen hubs

Hydrogen is a key priority for South Africa. In his last State of the Nation address, President Ramaphosa cited that hydrogen fuels cells are a national priority as an alternative energy source.

Hydrogen presents a significant opportunity for economic development in South Africa, including the creation of new jobs and the monetisation of the platinum industry. It is also a contributor to South Africa’s decarbonisation objectives, leveraging PP [1], REDZ [2] and other renewable development programmes to produce green hydrogen, now at the centre of many sector-level green strategies (e.g., green steel, green buildings).

Finally, global commitments towards hydrogen production and demand create an opportunity for South Africa to engage in energy export at the international level.

The South African Government’s Department of Science and Innovation (DSI), in partnership with Anglo-American, Bambili Energy and ENGIE are looking into opportunities to transform the Bushveld complex and larger region around Johannesburg, Mogalakwena and Durban into a Hydrogen Valley.

To realise these objectives for South Africa, Hydrogen Valleys can be leveraged to kickstart the hydrogen economy, leading to cost savings through shared infrastructure investments, improving the cost competitiveness of hydrogen production through economies of scale, enabling a rapid ramp-up of hydrogen production within a given territory, and leveraging an incubator for new pilot hydrogen project.

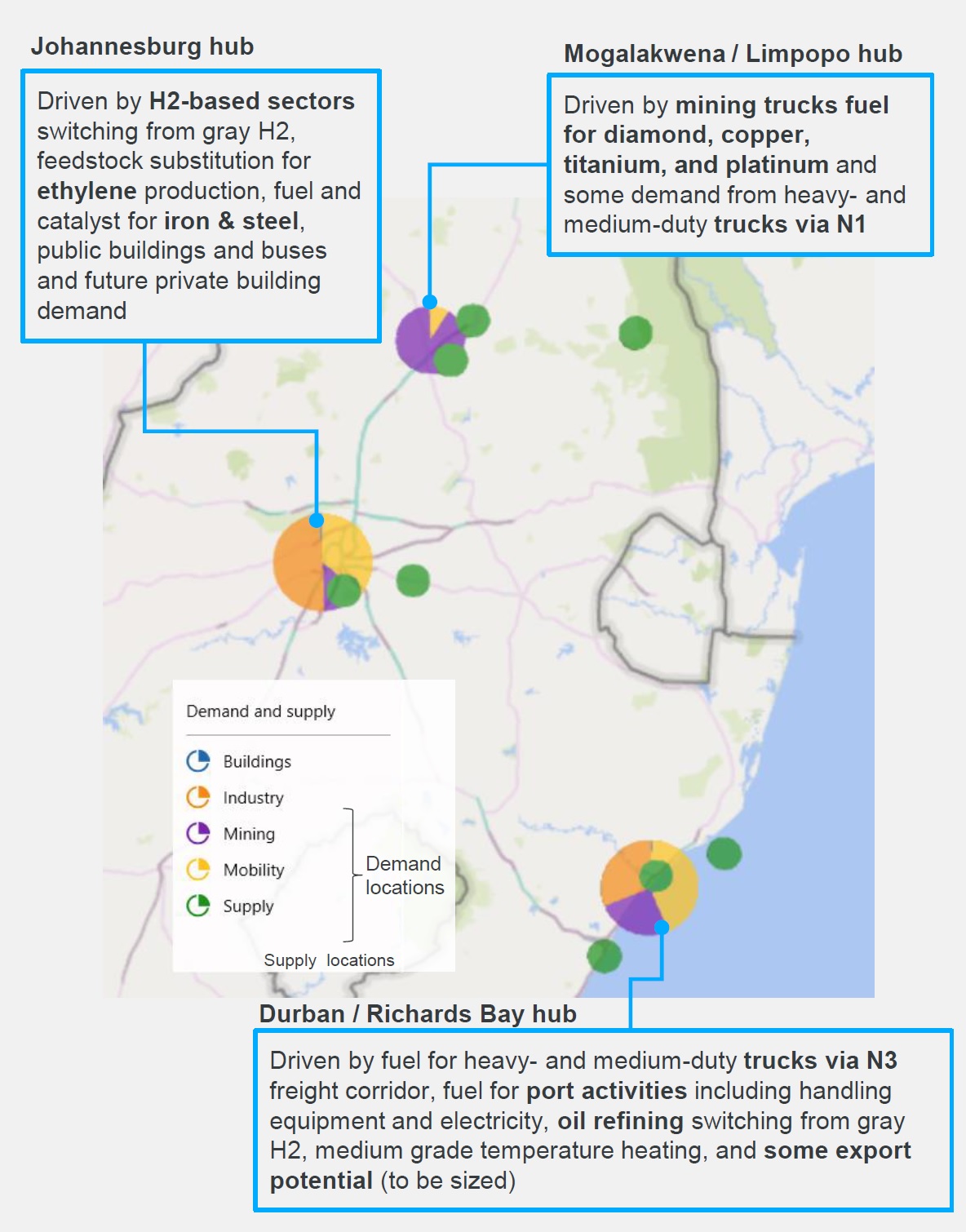

Three catalytic green hydrogen hubs have been identified in South Africa’s Hydrogen Valley These hubs have been identified based on locations with potential for a high concentration of future hydrogen demand, the possibility to produce hydrogen (e.g., access to sun/wind, water infrastructure), and contributions to the just transition—an economic development plan that brings positive social impact particularly to more fragile groups and communities. These hubs – in Johannesburg, Durban/Richards Bay, and Mogalakwena/Limpopo – will host pilot projects and contribute to the launch the hydrogen economy in the Hydrogen Valley.

Hydrogen demand

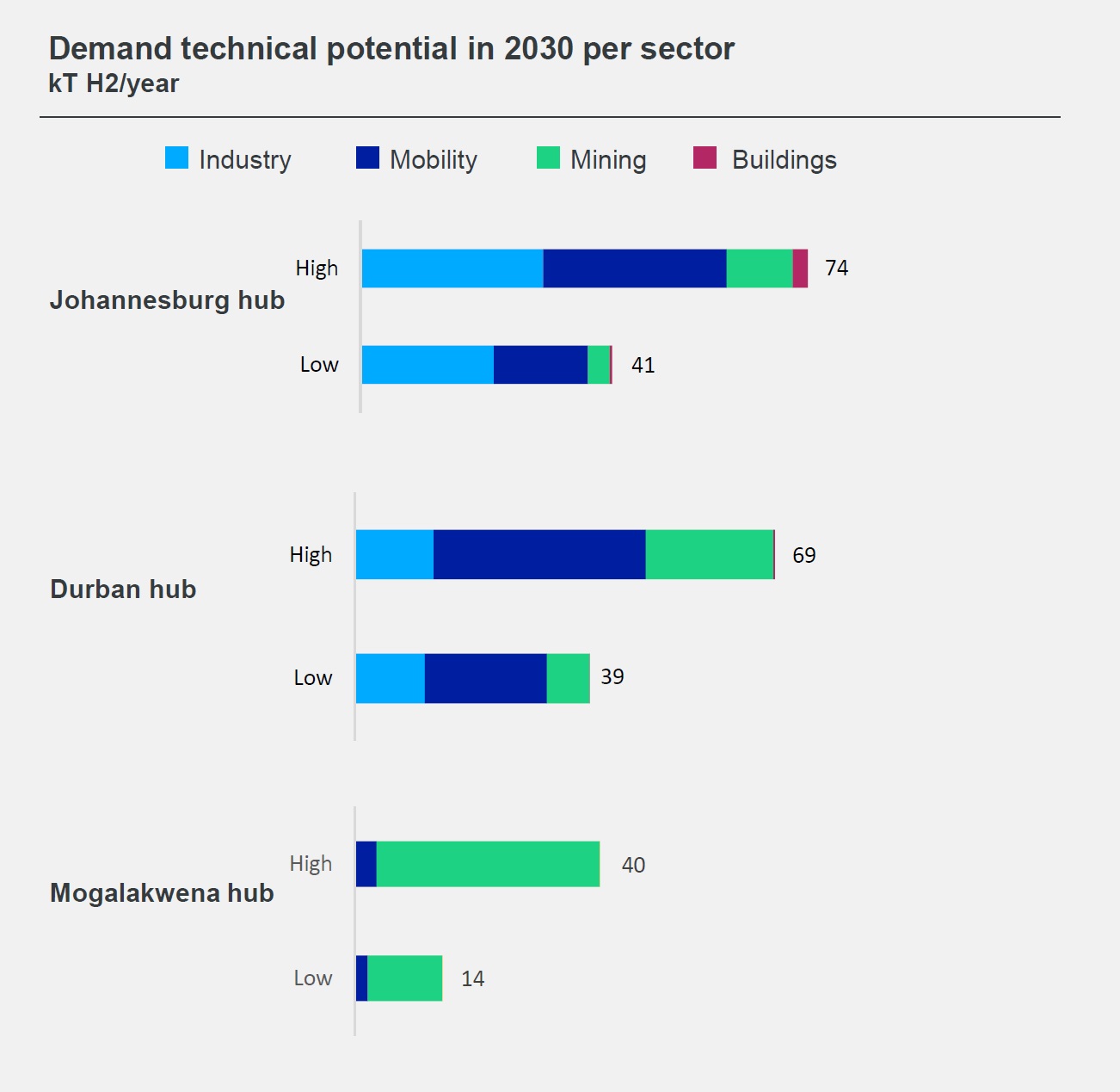

Hydrogen demand in the Valley could reach up to 185 kt H2 by 2030, or 40% (low demand case) to 80% (high case) of demand in the national hydrogen roadmap. Demand in the Valley has been developed based on a bottom-up assessment of technical potential of off-takers in each hub, complemented by hydrogen uptake curves reflecting the expected competitiveness of hydrogen in each application.

In Johannesburg, hydrogen demand could reach up to 74 kt by 2030 in a high uptake scenario. Demand is primarily driven by the industrial sector, with large H2 uptake in Sasolburg’s chemical and iron and steel sectors. There is also significant demand from heavy duty trucks servicing the N3 freight corridor, and public buses and buildings within the Johannesburg/Durban metropoles.

In Durban, hydrogen demand could reach 70 kt by 2030 in a high uptake scenario. Demand is primary driven by the mobility sector, with the growth of fuel cell heavy- and medium-duty trucks along the N3 freight corridor, as they reach cost parity with diesel trucks.

The ports of Durban and Richards Bay present opportunities for hydrogen in port operational vehicles such as forklifts and cold ironing from fuel cells as well as marine bunkering in the long-term. Some industrial demand, such as pulp and paper factories, and public building demand is also foreseen.

Mogalakwena/Limpopo is positioned as the mining hub, with 90% of its nearly 40 kt of H2 demand driven by possible demand from mining trucks across the region’s mines. The flagship Limpopo Science and Technology will also provide demand for fuel cells to power its building stock. Hydrogen export could be a potential future source of demand; however, the Valley will face competition from other hydrogen exporting countries such as Morocco and Australia and from other ports in South Africa such as Boegoebaai.

Nevertheless, the co-location of demand and supply gives synergies opportunities within the hub that will help initiate and scale up pilot projects. We therefore recommend that the Hydrogen Valley either consolidate domestic demand and create economies of scale before embarking on ambitious export projects or take an opportunistic stance such as leveraging international funds to develop export infrastructure.

Hydrogen supply

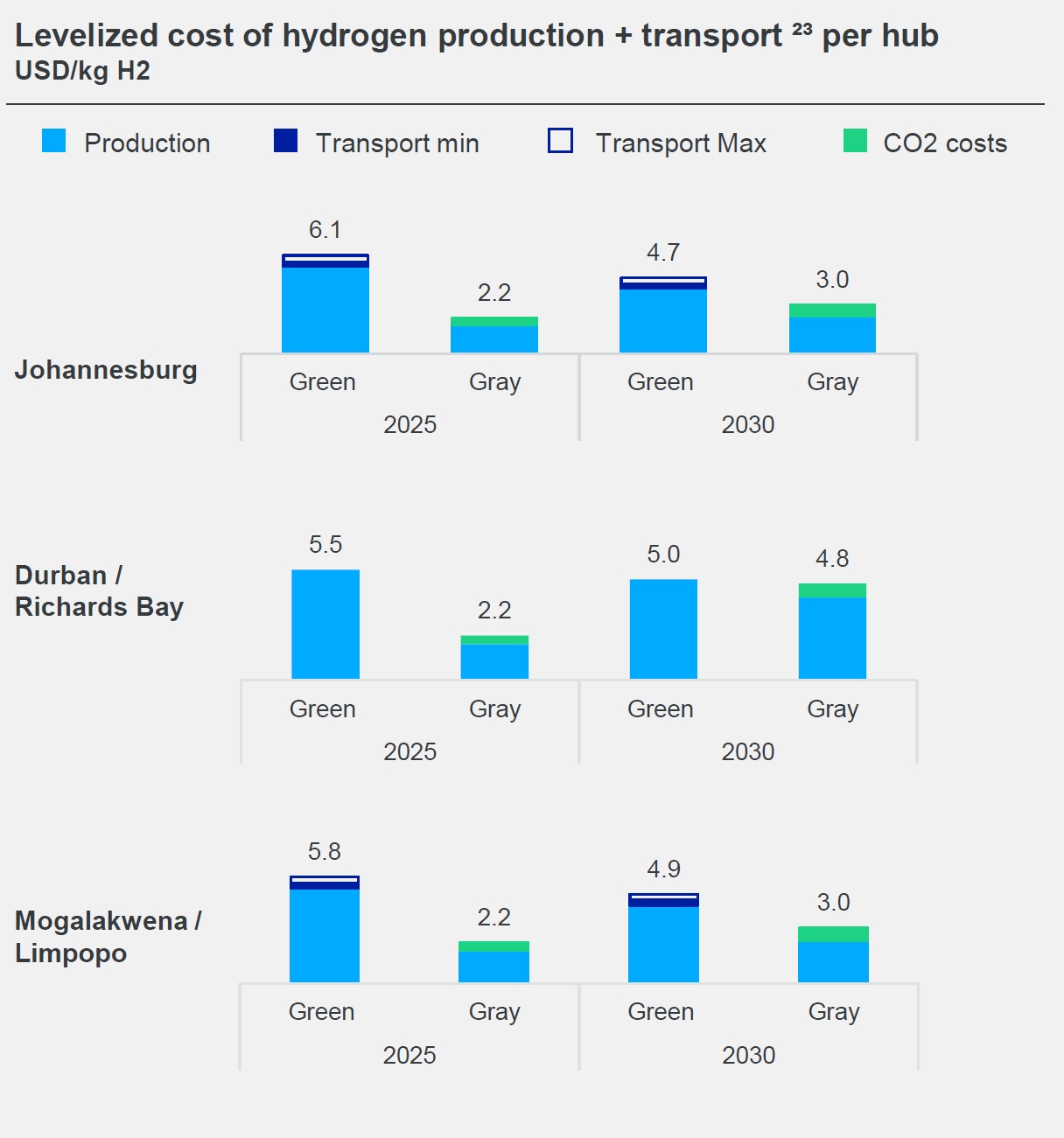

By 2030, green H2 LCOH is expected to be about $4 per kg H2 [1] across hubs, still more expensive than grey hydrogen, with a green premium of $2 to $2,5 per kg. All three hubs see similar costs of hydrogen production. Costs in 2030 will be lower in Johannesburg (US$4,08 to $4,11/kg H2) [4], compared to Durban ($4,25 to $4,55/kg H2) and Mogalakwena/Limpopo ($4,10 to 4,27/kg H2) due to higher solar irradiation levels.

Additional transports costing up to $0,5/kg H2 are considered to bring hydrogen from supply locations to offtakers within the hubs. With the addition of transport, hydrogen production costs reach $4,70 to $5,00/kg H2 by 2030 (see graph).

For all hubs, we recommend using solar PV for green hydrogen production, with some onshore wind as the cost optimal supply mix. South African H2 Valley LCOH estimates are higher than some other analyses, due to the use of PEM electrolysers instead of alkaline electrolysers, as well as conservative, yet significant cost-down assumptions (about 60% between today and 2030), based on observations about the limited impact of economies of scale in electrolyser installations.

Our electrolyser costs go beyond capex to include the full cost of installation. We have also taken a conservative approach in LCOH cost evolution and recognised that further reductions are possible depending on policy and technology evolution to 2030.

Given the estimated demand of hydrogen, the optimal transport solution consists of transporting hydrogen by truck from the production site to off-takers, while hydrogen pilot projects take shape and begin to scale. Building a hydrogen pipeline requires high levels of hydrogen demand before becoming economically viable.

The report anticipates infrastructure constraints, and each hub must anticipate infrastructure requirements in electricity supply, water supply, pipeline infrastructure and storage. For electricity supply, a dedicated RES off-grid supply is recommended to mitigate grid reliability risks and avoid network charges and taxes. Most hubs are vulnerable to water supply and hubs may consider locating hydrogen supply next to existing water sources, desalination infrastructure, or implementing water recycling or truck delivery. With no extensive H2 network in the region, existing gas pipelines could be leveraged for H2 transport and distribution in the longer term. While underground storage is not feasible before 2030, above ground storage can be leveraged to lower LCOH.

Socioeconomic impact

The H2 Valley could potentially add up to $8,8 billion to GDP (direct and indirect contributions) by 2050, while also creating 30 000 (or more) direct and indirect jobs per year. Spending on capex and opex hydrogen production, from offsite renewable energy supply and electrolyser capacity, for the full vision of the Hydrogen Valley is expected to have a positive impact on GDP and job creation.

Estimates have placed the potential GDP impact, both direct and indirect, of the hydrogen projects at $3,9 billion (low demand case) to $8,8 billion (high demand case) should the full vision of the Hydrogen Valley be realised.

Estimates also indicate job creation opportunities from projects in the Valley, putting in place about14 000 (low case) to 32 000 (high case) jobs per year by 2030, should the full vision of the project be realised. These jobs are based on the RES and electrolyser investment only; fuel cell investment may further contribute to job creation beyond these figures.

This job growth may be seen in sectors across the whole hydrogen value chain, starting at the sourcing of resources such as water resources management and platinum mining, to production including electrolyser development, to transport including the pipeline and trucking industries, to storage such as liquefaction, to finally applications such as fuel cell manufacturing. Jobs span the entire hydrogen value chain from R&D, engineering, maintenance, training, and outreach.

This job creation also has the potential to contribute to the just transition; for example, jobs requiring training the workforce will put male and female workers on equal footing. The PGM sector is expected to see a marginal increase in demand from the Hydrogen Valley, as platinum is a required raw material for both fuel cell and (PEM) electrolyser manufacturing. However, the volume of platinum required for the Valley only constitutes a small percentage of platinum production today. No platinum supply constraint to satisfy the demand of the Valley is anticipated. The proposed projects in the Hydrogen Valley could bring up to $70 million (high case) to platinum industry in South Africa in 2030.

Regulatory and policy enablers

Regulatory and policy enablers are required to kickstart the hydrogen economy. While South Africa has already put in place many policies that can nurture the hydrogen economy, multiple barriers still exist to scale up hydrogen in the Valley.

These barriers relate to sourcing green electricity (grid reliability and limited green electricity on grid), electrolyser scale up (high costs), hydrogen demand (lack of clear targets and strategies at the sector level), and infrastructure (missing hydrogen transport and storage regulation), among others. Policy and regulatory enablers should ease deployment of RES and electroysers, make near-term capex affordable, encourage H2 applications, create momentum for future demand, and formalise the hydrogen sector through standards and labels. Supporting policies around RES deployment, land and water use must also be coherent with creating a hydrogen economy and sustainable future.

Across each of these categories, we recommend a suite of policy and regulatory instruments:

• To ease deployment of RES and electrolysers, we recommend offering financial incentives to lower capex cost and fast track RES deployment through simplified permitting procedures.

• To make near-term capex affordable for hydrogen supply infrastructure, we recommend the following suite of policy instruments: direct financial support, financial incentives and CO2 taxes.

• To create momentum for future demand, it is important to put in place sector planning to provide transparency on future off-take and encourage technology partnerships between suppliers and off-takers to share risk of new projects.

• Finally, standards and labels are required to harmonise technology specifications and guarantee safety of hydrogen production, transport and of applications.

Proposed pilot projects

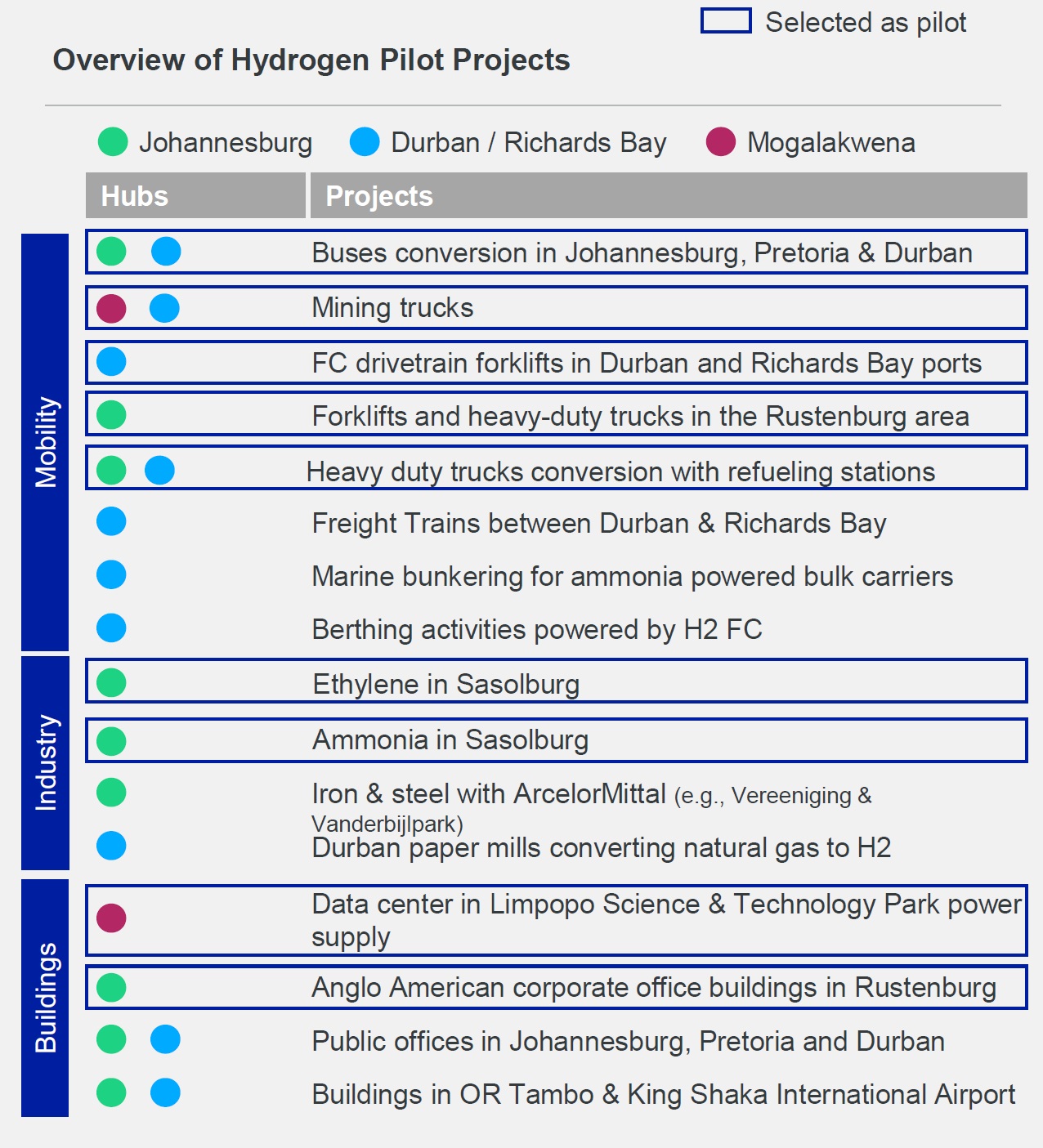

Nine catalytic projects across the mobility, industrial and buildings sectors have been identified to kickstart the hydrogen economy in the Valley.

Across Johannesburg, Durban/Richards Bay and Mogalakwena/Limpopo, we have identified about15 projects of interest in the Valley, with nine promising pilot projects which should be the near-term focus of Valley developers.

In the mobility sector, there is already momentum in place to deploy mining trucks (e.g., project Rhyno in Mogalakwena) and heavy-duty trucks along the N3 corridor. Thorough analysis and a stakeholders meeting indicated piloting mobility applications in the Durban and Richards Bay port environment (e.g., forklifts), public buses and metropoles and berthing activities in the port of Durban powered by fuel cells. For longer-term activities, marine bunkering for ammonia could be deployed, as hydrogen in the maritime sector is a strategic priority [5] though not yet cost competitive. A fuel cell train between Durban and Richards Bay could be interesting once the technology is further developed.

The industrial sector already sees many pilot projects underway that could be supported by this project. Sasol has committed to developing ethylene and ammonia from green hydrogen. Green steel is a national priority, and there could be an opportunity to pilot green steel production with Arcelor Mittal at one of its sites near Johannesburg.

The government is interested in reducing emissions in the paper and pulp sector, presenting an opportunity for Durban-based paper mills to switch from natural gas fuel to hydrogen. In the buildings sector, the Limpopo Science and Technology Park, as well as Anglo-American corporate office buildings in Rustenburg, have already planned to install fuel cells for power.

Other pilot opportunities have been identified on the field of public office buildings in metropoles and airport buildings at OR Tambo and King Shaka airports [6]. Data centres, corporate headquarters, and private office buildings see rising interest in hydrogen fuel cells for stationary power, with potential for rapidly growing demand in the near future [7].

Notes

(1) Includes cost of producing hydrogen (cost of renewable energy supply and electrolyser only; does not include transport nor storage as demand assumed to be fully flexible

(2) Transports in Mogalakwena not accounted for as production will be on localized

(3) Transport costs of grey hydrogen are not accounted for

(4) Ranges based on location within hub

(5) Ricardo, 2021

(6) Alternatively, airports may integrate fuel cells through mobility applications (e.g., buses, operational vehicles)

(7) Demand not sized in this report due to lack of data

This is the executive summary of the report