Information from African Energy Chamber

Niger’s new solar projects pave the way for a diversified energy mix

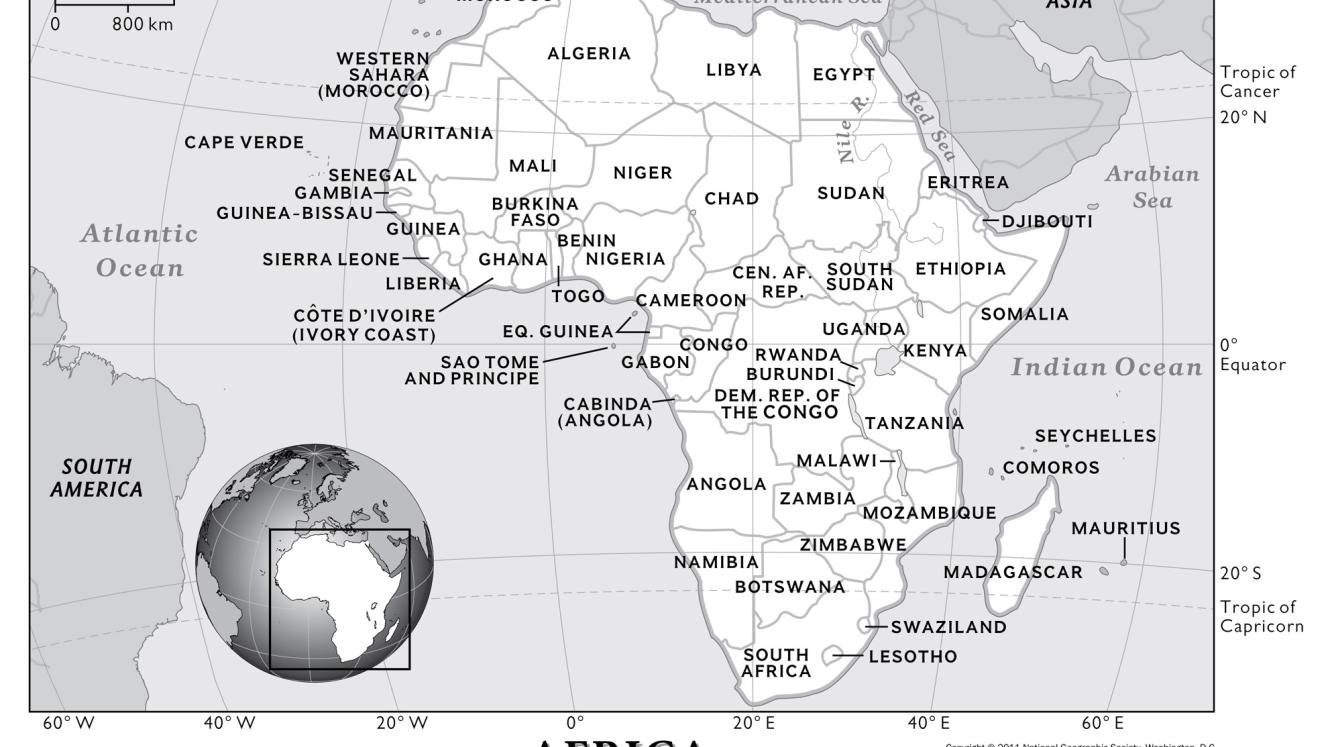

Savannah Energy Niger Solar Limited, a subsidiary of British energy company Savannah Energy, and the Government of Niger have agreed on the development of two solar photovoltaic power plants with a combined capacity of up to 200 MW. The plants are set to be located about 20 km from Maradi and Zinder in southern Niger, with an installed capacity of between 50 MW and 100 MW respectively. These projects are expected to increase the country’s grid-connected power generation by over 20%, providing reliable and affordable energy to all. Additionally, the solar plants are set to reduce annual CO2 emissions by an estimated 260 000 tonnes. Once the necessary feasibility studies are completed, first power generation is expected by 2025 or 2026. Savannah plans to finance the initiative through a combination of its own generated cashflows and project-specific debt.

Pipeline to convey African crude to international markets

Uganda and the Democratic Republic of the Congo (DRC) are working on a memorandum of understanding (MoU) which would see oil produced at exploration blocks in the DRC’s Albertine Graben being transported via the East African Crude Oil Pipeline (EACOP) – a 1443 km-long heated pipeline connecting Uganda’s Kingfisher and Tilenga oilfields with international markets via the Tanga Port in Tanzania.

While the construction of the EACOP continues to be faced with interference by international environmental groups, the bilateral meeting and upcoming MoU are a testament to the role the pipeline will play in East Africa.

The MoU would enable Uganda and DRC to export oil from oilfields located in the Albertine Rift Basin, also known as Albertine Graben. Much of the rift area remains underexplored, but now, with the DRC opening up 30 oil and gas blocks for exploration in 2022, new discoveries are on the horizon as players move to replicate success seen across the border in Uganda. The EACOP offers a solution to getting high-demand crude to international markets.

In addition to benefits created through revenue generation from exports, the pipeline and associated upstream business is expected to open opportunities for job creation, infrastructure development, market access and other crucial economic prospects. The pipeline will also enable East African consumers to tap into regional energy supplies, thereby tackling security across the energy-poor region. The EACOP is on track to commence production in 2025. China is expected to step in as the primary financier, leveraging the country’s already strong presence in both the region and the pipeline’s development to see the EACOP’s completion.

Gabon’s youth to benefit from local content programme

Gabon is focusing on a local content programme to strengthen its oil sector. The country started increasing the participation of local firms in the hydrocarbons sector in 2011 with the introduction of its Local Content Law, following a comprehensive assessment of the domestic industry and study of international best practices. A key legislative feature is the definition of indigenous companies as entities registered in the country that are at least 60%-owned by locals and where Gabonese nationals comprise at least 80% of the workforce. Such companies are preferred by the government in awarding rights for the exploitation of marginal fields. They are also subjected to a lower corporate tax rate and are provided concessionary terms for the import of equipment and machinery.

This has yielded a twin benefit for the domestic industry. First, international oil majors that wish to operate marginal oil fields in Gabon must engage domestic firms, thereby generating employment opportunities and service contracts for Gabonese workers and firms. Secondly, it encourages local companies to adopt the latest technologies required to reverse declines in production in mature oil fields, helping them to acquire the technical and digital skills needed to move up the oil and gas value chain.

To facilitate this, the government has implemented a series of innovative local content initiatives, including the creation of a fund to finance local companies in the hydrocarbons industry. The fund provides financial support to local companies to help them compete with international companies for industry contracts. The government has also been working on developing a database to monitor the progress of local companies in the industry.

Demographics are a major factor driving the country’s local content policies. Gabon boasts a fast-growing population, with more than 50% of its citizens below 16 years of age. While the Gabonese economy scores higher than its regional peers in female workforce participation, the unemployment rate among women is still twice as high as among men. Despite its sizable youth population, a lack of technical expertise widens the skills gap, and it is estimated that two-thirds of all vacancies for Gabonese workers remain unfilled. Historically, the public sector employed more than half of the country’s workforce, but ensuring employment for future generations requires the expansion of the private sector and higher female participation in the workforce.

But plans are afoot to address these issues, with the oil and gas industry at the heart of the solution. Authorities are implementing affirmative action policies to increase the participation of women and youth in the industry, including granting scholarships to female students to study engineering and other STEM-related fields. The government is also developing and subsidizing vocational training programs to equip job-market entrants with the necessary skills to work in the industry. Incentives are also being offered to companies working in logistics and infrastructure to help develop skills in ancillary services. These efforts are set to dramatically improve Gabon’s importance as a regional logistics hub and trade conduit.