Growing global investment in renewable energy infrastructure is reshaping the operational landscape of the energy transition but gaps remain in funding and development of mid-scale projects, green hydrogen production and new demand-driven sectors, say Minal Patel, Global Head of Infrastructure at Schroders Capital, James Samworth, Co-Head of Energy Transition at Schroders Greencoat, and Paul O’Donnell, Partner at Schroders.

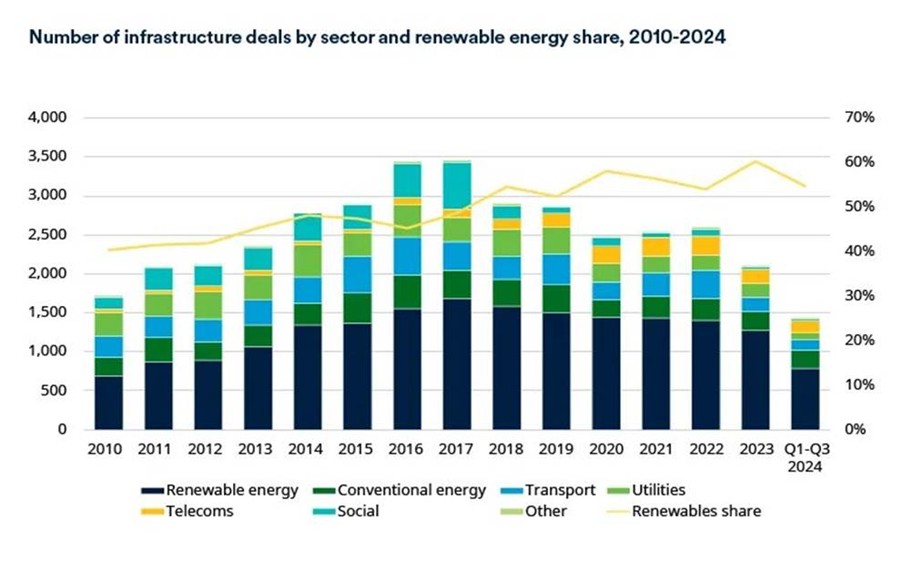

Energy transition investment is a critical component of the broader infrastructure landscape. Renewable energy alone has consistently accounted for between 50% and 60% of completed transactions since 2018 and, in aggregate, half of total infrastructure deal volume over the past 15 years.

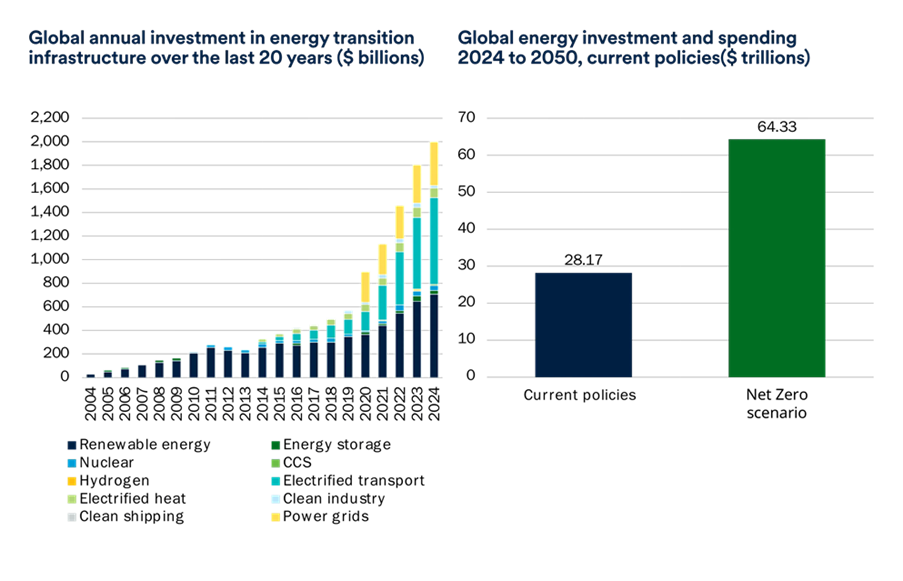

Global investment in energy transition infrastructure has increased sharply over the past five years, reaching €2 trillion in 2024. The demand for capital continues to grow with US$28 trillion of investment implied over the next three decades under current government policies – and more than double that needed to meet global net zero targets by 2050.

This raises the question: where within this expanding universe might investors concentrate their capital to most effectively capture the performance and resilience potential of the global energy transition?

Lower and mid-market developer and platform investments

We observe a dual trend: large infrastructure funds are concentrating on low-risk, very large-scale operational renewables while venture capital is flowing into start-up climate technology companies at the other end of the risk and scale spectrum. This has created a “missing middle” where mid-market energy transition opportunities are often overlooked.

Investing in earlier-stage and lower or mid-market assets as platform investments offers a compelling way to address this gap. Growth can be achieved through organic expansion – by developing and building new assets – as well as through strategic bolt-on acquisitions.

Successful scaling creates a wide array of exit options from sales to larger infrastructure funds or strategic energy buyers to public listings.

Green hydrogen development as a key fuel

Green hydrogen presents another critical opportunity. Growth in this sector is being driven by government support and targeted regulatory initiatives worldwide.

The International Energy Agency estimates that low-emissions hydrogen production has risen by more than 50% since 2021, entirely attributable to renewables-powered green hydrogen. Installed electrolyser capacity reached 5,2 GW in 2024, a ninefold increase since 2021 and a threefold increase year-on-year.

While the green hydrogen market has previously experienced a “false dawn”, we believe the current trajectory is more sustainable. Governments and specialist investors are increasingly linking production to specific end-use cases, helping to build real demand as the energy transition gathers pace.

To achieve the necessary expansion and meet global net zero targets, an estimated US$150 billion of additional investment will be needed through 2030 – not only to scale production capacity but also to enable end-use applications in hard-to-abate industrial sectors.

Notably, expansion in green hydrogen will also drive broader renewable energy demand, given the strong symbiotic relationship between green hydrogen production and renewables.

Enabling and growing new renewable energy demand drivers

Much of the early focus of the energy transition was on expanding renewable generation. The equally important next phase is enabling the demand drivers that will utilise the green electrons produced.

These include:

- The heating of homes and businesses through heat pumps and district heating networks.

- The electrification of transport through electric vehicles requiring charging infrastructure.

- The delivery of powered land for data centre hyperscalers.

- The expansion of transmission and distribution networks, including interconnectors.

This surge in power demand is emerging at a time of renewed scrutiny over the role of renewables, particularly in the United States. Nevertheless, we believe companies –particularly technology companies – are unlikely to abandon their climate commitments, given the growing expectations of their employees, customers and shareholders, especially among younger generations.

Opportunities for infrastructure investors lie not only in building and operating assets but in directly connecting powered sites to renewable generation, navigating jurisdictional complexities for grid access, managing energy storage solutions and structuring power purchase agreements to ensure cost certainty.

In short, success will require more than capital; it will require deep operational expertise.

We believe that investing in these areas – scaling mid-market platforms, supporting green hydrogen development and enabling new electrified demand – provides compelling opportunities to contribute to, and benefit from, the progressive stages of the journey to net zero: decarbonising power generation, electrifying power demand and enabling the decarbonisation of hard-to-abate sectors.